Managing your finances just got easier! Check out the best budgeting apps for Indians in 2025 and start saving smarter today.

Introduction

Managing finances can often feel like a daunting task, but with the rise of technology, it has never been easier to stay on top of your spending and savings. In 2025, a variety of budgeting apps offer powerful features tailored to help Indians control their finances efficiently. Whether you’re trying to save for a big purchase or just want to better track your monthly expenses, these apps provide smart solutions to keep your financial goals on track.

Why Budgeting Is Crucial in 2025

In the fast-paced world we live in, where prices are constantly rising, managing personal finances is essential for financial well-being. A solid budget helps you prioritize spending, track income, save for emergencies, and achieve your financial goals. Thankfully, budgeting apps provide a simple way to monitor your financial health, track your progress, and optimize your spending habits without the need for complicated spreadsheets or calculators.

Top Budgeting Apps for Indians in 2025

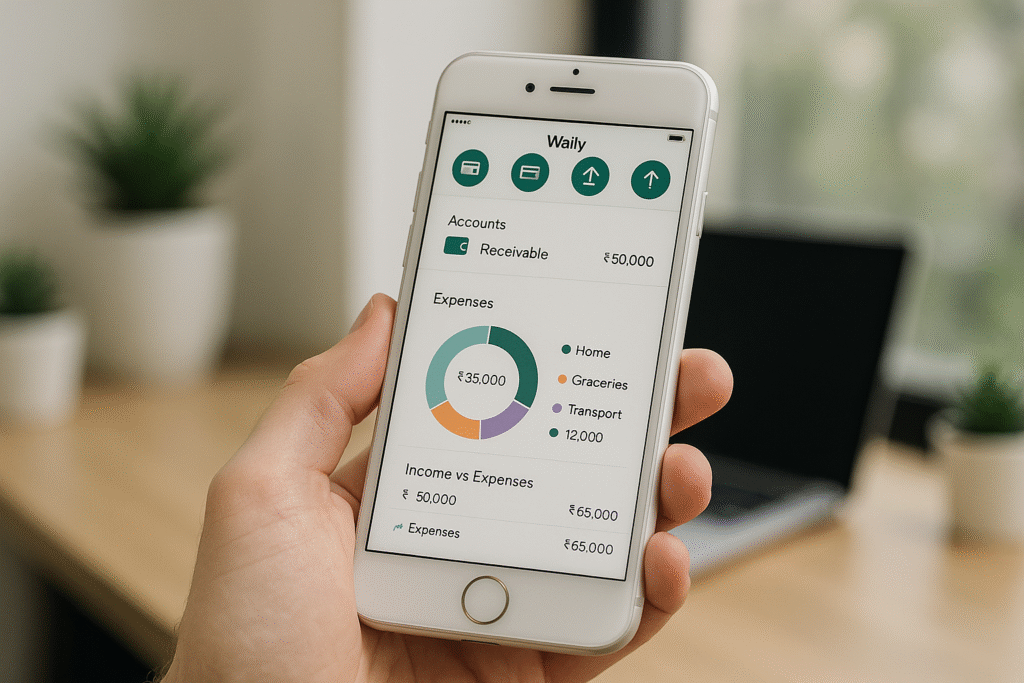

1. Wally – A User-Friendly Finance Tracker

Wally is an intuitive and easy-to-use app that helps you track your income and expenses. Available for both iOS and Android, Wally lets you record your financial transactions in various categories, including groceries, entertainment, and bills. The app also provides insights into your spending habits, helping you save more by identifying areas where you can cut back.

Features:

- Track expenses in multiple currencies

- Set budget goals

- Smart savings suggestions

- Secure and private

2. Mint – All-In-One Personal Finance Manager

Mint is one of the most popular budgeting apps worldwide, and it offers a robust suite of tools for Indians too. This app connects all your bank accounts, credit cards, and investments to give you a complete picture of your finances. Mint categorizes your expenses automatically and sends you reminders for bill payments, so you never miss a due date.

Features:

- Expense categorization

- Bill payment reminders

- Investment tracking

- Credit score monitoring

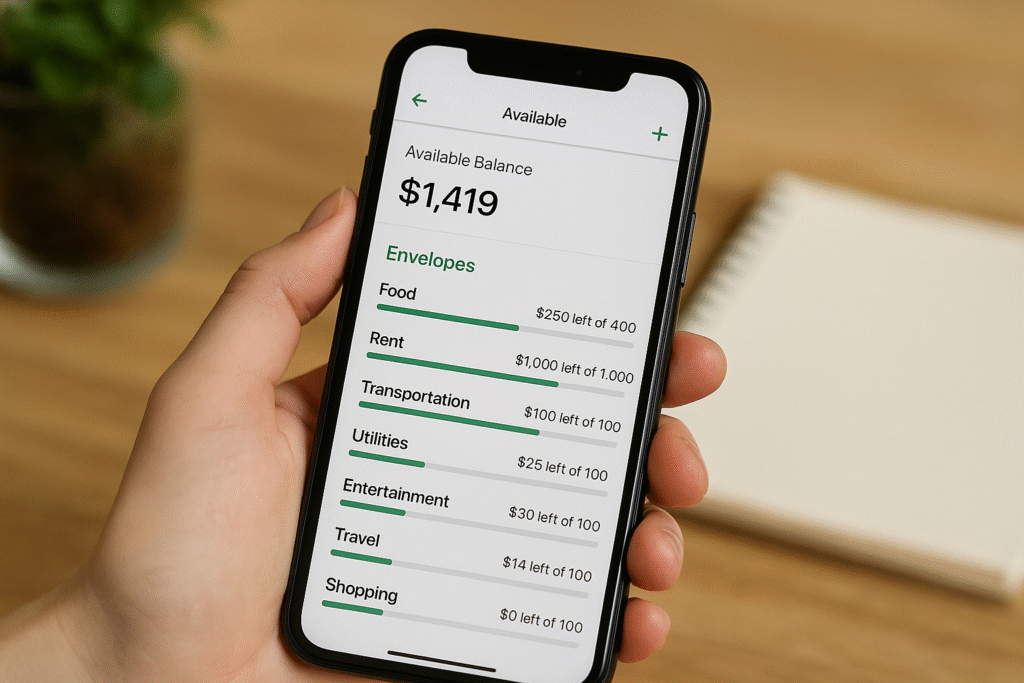

3. GoodBudget – Envelope Budgeting System Made Digital

If you prefer a more traditional approach to budgeting, GoodBudget brings the “envelope” method into the digital age. By allocating money into virtual envelopes for different spending categories, you can stick to your budget without the hassle of cash. This is particularly useful for users who want to manage both their daily and long-term financial goals.

Features:

- Digital envelope system

- Debt tracking

- Sync across multiple devices

- User-friendly interface

4. Money View – Personalized Budgeting for Indians

Money View is an app tailored specifically for Indian users, offering features that cater to local needs. It provides insights into your spending and categorizes expenses based on real-time data from your bank transactions. Additionally, Money View helps you with credit score monitoring and gives recommendations on how to save more.

Features:

- Personalized financial advice

- Bill reminders

- Credit score monitoring

- Bank sync for transaction tracking

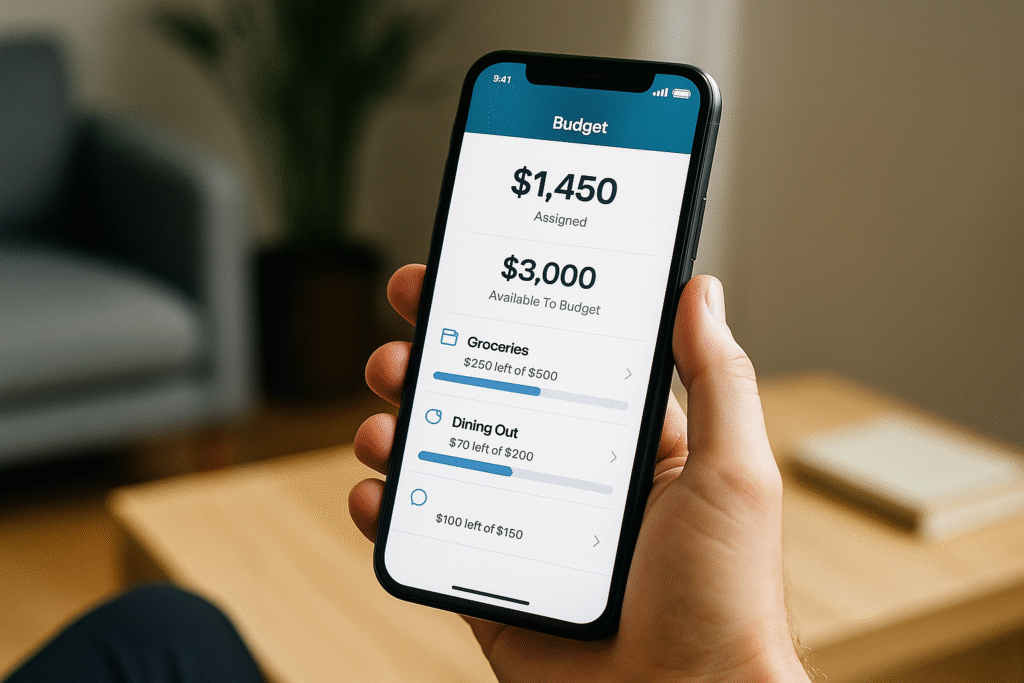

5. YNAB (You Need A Budget) – Empowering Financial Freedom

YNAB offers an advanced approach to budgeting with its unique method that focuses on zero-based budgeting. Every rupee you earn is assigned a specific job, whether it’s paying bills, saving, or investing. This app is excellent for those who want to take control of their finances and break the paycheck-to-paycheck cycle.

Features:

- Zero-based budgeting

- Goal setting

- Sync with bank accounts

- Financial education resources

How to Choose the Best Budgeting App for You?

When choosing a budgeting app, consider the following factors:

- Ease of use: You want an app that’s simple and quick to navigate.

- Bank sync: Connecting your bank account ensures accurate tracking.

- Features: Look for apps that meet your specific financial needs (e.g., savings goals, credit score monitoring).

- Security: Ensure the app offers strong encryption to protect your financial data.

Conclusion

Managing your finances doesn’t need to be stressful. With the best budgeting apps for Indians in 2025, you can take control of your money, track your spending, and start saving effectively. Whether you’re looking for simplicity or advanced features, there’s an app for everyone. Start using these apps today and make your financial goals a reality.

Disclaimer

This blog is intended for informational and educational purposes only. The views expressed are personal opinions or general insights, not professional or legal advice. Readers should do their own research or consult relevant professionals before taking action based on this content.

#BudgetingApps #FinanceTips #Carrerbook #Anslation #PersonalFinance #IndianFinance #MoneyManagement #BudgetingMadeEasy #SavingMoney #SmartFinance #FinanceGoals #FinancialPlanning #BudgetAppsIndia #MoneyView #WallyApp #YNABIndia #MintApp

Leave a Reply